Pension Indicator Updated for March 31, 2024

Welcome Spring

By: Brian Wunderle, Managing Director, Clearstead

The corporate pension plan ecosystem is likely the healthiest it has been in years. A gamut of factors—higher discount rates, shrinking pension liabilities, a continued focus on liability hedging, a reduced reliance on public equities, and greater market capitalizations for plan sponsors—have diminished the volatility that was often associated with corporate pension plans.

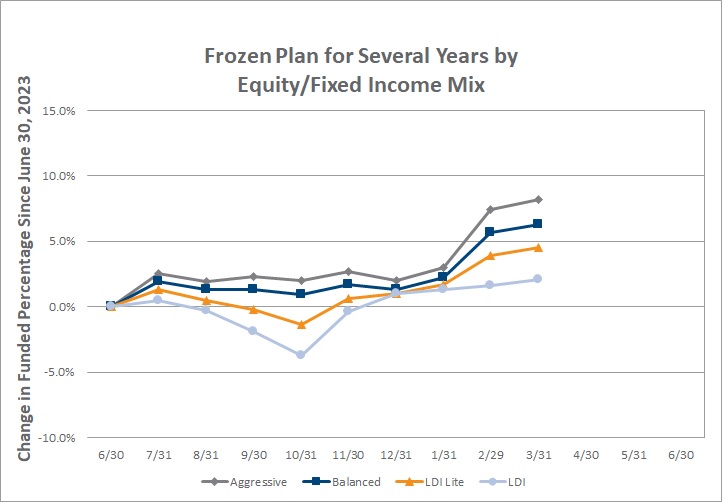

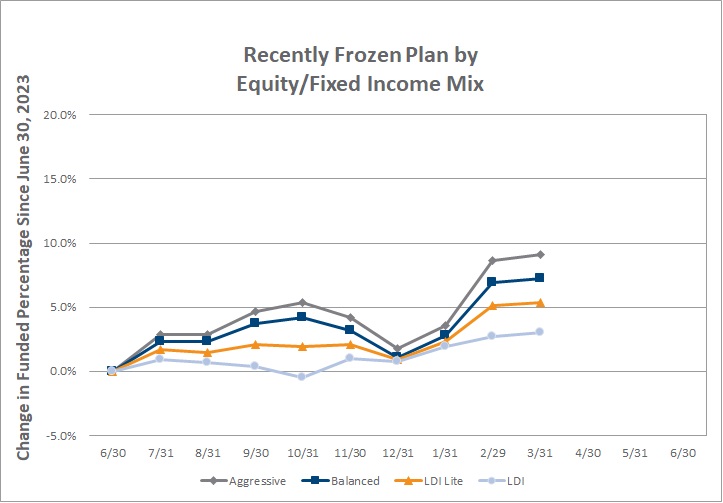

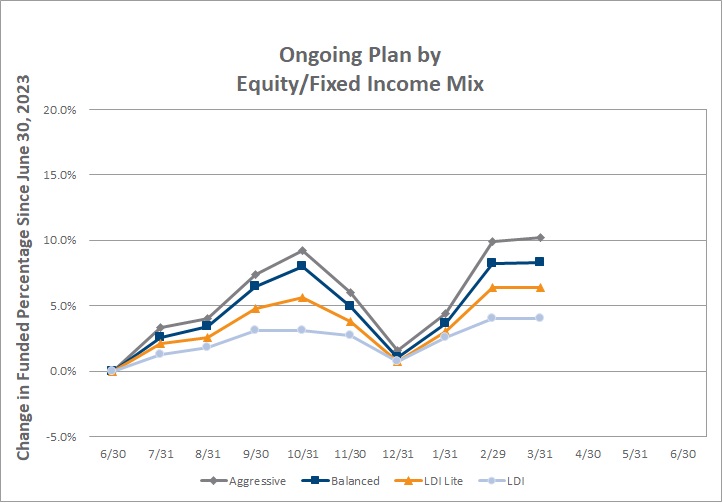

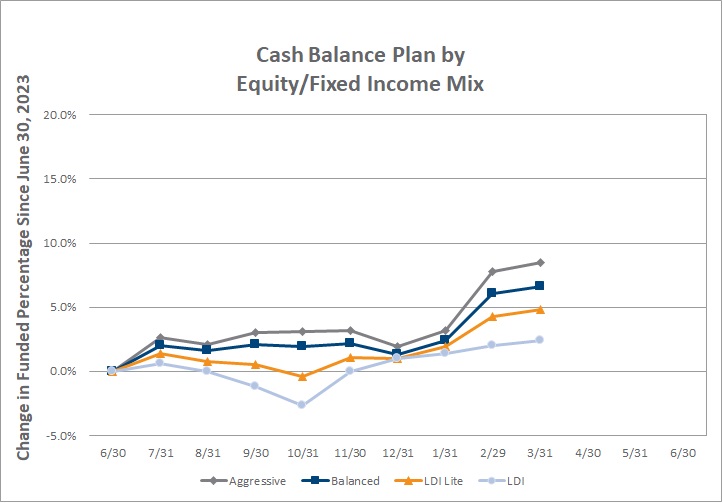

Corporate pension plans capped off a strong first quarter of funded status gains with most asset classes registering positive returns. A balanced equity portfolio1 returned approximately 2%, offsetting a slight increase in pension liabilities as yields fell slightly.

The aggregate funded ratio for U.S. corporate pension plans increased by an estimated 1% in March2. Positive returns out of risk assets in the last five consecutive months have driven many Sponsors to historically high funded ratios. There was an estimated improvement of 4-5% in the first quarter alone.

The de-risking trend continues to be more popular for plan sponsors to capitalize on improvements in funded status and this period of higher discount rates. With funded status remaining elevated for many plans, Clearstead recommends clients maintain or even increase interest rate hedge ratios to protect funded levels. The current pension environment presents an opportune time for corporate plan sponsors to evaluate their goals and objectives with respect to their plans, whatever they may be, and decide whether action may be warranted.

As always, thanks for reading, and drop us a comment on how we're doing.

This email address is being protected from spambots. You need JavaScript enabled to view it. or Clearstead to discuss this information further.

For more information on the development of the Pension Indicator, please see our Disclosure document.

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. Performance data represents past performance. Past performance is not indicative of future results.

1Balanced Portfolio represented by 50% S&P 500 and 50% Bloomberg Aggregate. Past performance is not an indicator of future returns.

2Bloomberg

| Year to Date Investment Mix (Net) | ||||

|---|---|---|---|---|

| Plan Type | Growth | Balanced | LDI Lite | LDI |

| Frozen (for several years) | 6.1% | 5.0% | 3.5% | 1.1% |

| Recently Frozen | 7.1% | 6.0% | 4.4% | 2.1% |

| Ongoing Traditional | 8.2% | 7.1% | 5.5% | 3.1% |

| Cash Balance | 6.4% | 5.3% | 3.7% | 1.4% |

| Month-over-Month Investment Mix (Net) | ||||

| Plan Type | Growth | Balanced | LDI Lite | LDI |

| Frozen (for several years) | 0.7% | 0.6% | 0.5% | 0.4% |

| Recently Frozen | 0.4% | 0.3% | 0.3% | 0.1% |

| Ongoing Traditional | 0.1% | -0.1% | -0.1% | -0.2% |

| Cash Balance | 0.6% | 0.4% | 0.4% | 0.3% |

| 12-Month Change Investment Mix (Net) | ||||

| Plan Type | Growth | Balanced | LDI Lite | LDI |

| Frozen (for several years) | 17.0% | 14.0% | 11.1% | 7.1% |

| Recently Frozen | 18.0% | 15.0% | 12.0% | 8.0% |

| Ongoing Traditional |

19.1% | 16.1% | 13.1% | 9.0% |

| Cash Balance | 17.4% | 14.4% | 11.5% | 7.4% |

Please click on the "Historical" tab at the top of the website for longer time periods, including Five-Year and Return Since Inception (1/1/2016).